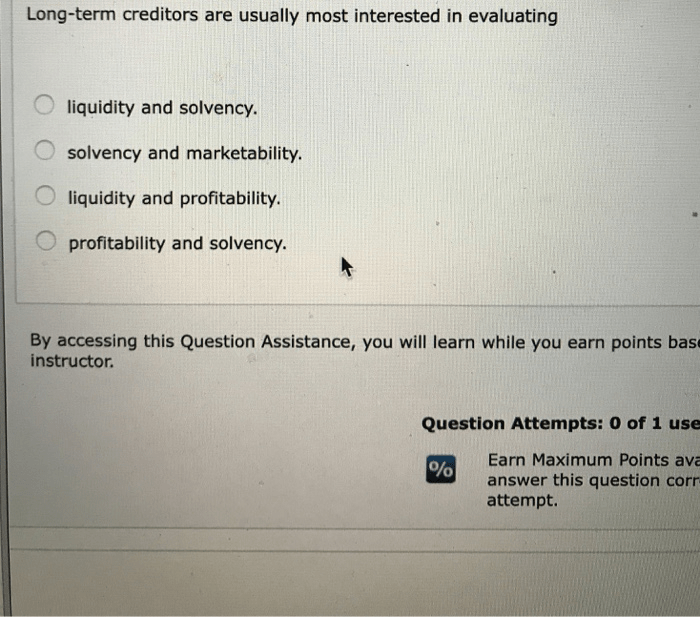

Liquidity ratios are particularly important to -term creditors. – Liquidity ratios are particularly important to short-term creditors because they provide insights into a company’s ability to meet its short-term obligations. These ratios assess a company’s liquidity, which is crucial for creditors who extend credit for periods of less than a year.

Short-term creditors rely on liquidity ratios to evaluate a company’s financial health and make informed lending decisions. By analyzing these ratios, creditors can identify potential risks and opportunities, ensuring that their investments are secure.

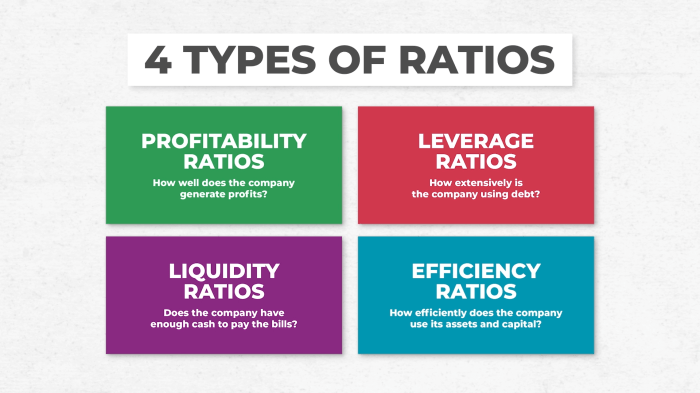

Understanding Liquidity Ratios

Liquidity ratios are financial metrics that measure a company’s ability to meet its short-term obligations. They are important for assessing a company’s financial health because they provide insights into the company’s ability to generate cash and cover its current liabilities.

Liquidity ratios are calculated using data from a company’s balance sheet and income statement. The most common liquidity ratios include the current ratio, quick ratio, and cash ratio.

Liquidity Ratios for Short-Term Creditors: Liquidity Ratios Are Particularly Important To -term Creditors.

Liquidity ratios are particularly important to short-term creditors because they provide insights into a company’s ability to repay its short-term debts. Short-term creditors are typically banks, suppliers, and other businesses that provide financing to companies for periods of less than one year.

Short-term creditors use liquidity ratios to evaluate a company’s ability to meet its current obligations and to identify potential risks. A company with low liquidity ratios may be more likely to default on its short-term debts, which can lead to financial distress or bankruptcy.

Using Liquidity Ratios for Decision-Making, Liquidity ratios are particularly important to -term creditors.

Short-term creditors use liquidity ratios to make decisions about lending or extending credit to companies. The following are some examples of how short-term creditors use liquidity ratios in their decision-making process:

- To assess a company’s ability to meet its current obligations

- To identify potential risks and opportunities

- To set credit limits and interest rates

Factors Considered by Short-Term Creditors

When evaluating liquidity ratios, short-term creditors consider a number of factors, including:

- The industry in which the company operates

- The company’s size and stage of development

- The company’s financial history

- The company’s management team

Limitations of Liquidity Ratios

Liquidity ratios are a useful tool for assessing a company’s financial health, but they have some limitations. Liquidity ratios only provide a snapshot of a company’s financial condition at a specific point in time. They do not take into account factors such as the company’s future cash flows or its ability to generate additional financing.

In addition, liquidity ratios can be manipulated by companies to present a more favorable financial picture. For example, a company can increase its current ratio by selling off inventory or by delaying the payment of its bills.

Interpreting Liquidity Ratios

When interpreting liquidity ratios, it is important to consider them in the context of a company’s overall financial performance. Other factors that should be considered include the company’s profitability, its debt-to-equity ratio, and its cash flow statement.

By considering all of these factors, short-term creditors can get a more complete picture of a company’s financial health and make more informed lending decisions.

Commonly Asked Questions

What are the most important liquidity ratios for short-term creditors?

The most important liquidity ratios for short-term creditors include the current ratio, quick ratio, and cash ratio.

How do short-term creditors use liquidity ratios to make lending decisions?

Short-term creditors use liquidity ratios to assess a company’s ability to meet its short-term obligations and make informed lending decisions.

What are the limitations of using liquidity ratios?

Liquidity ratios should not be used in isolation and should be considered in the context of a company’s overall financial performance.